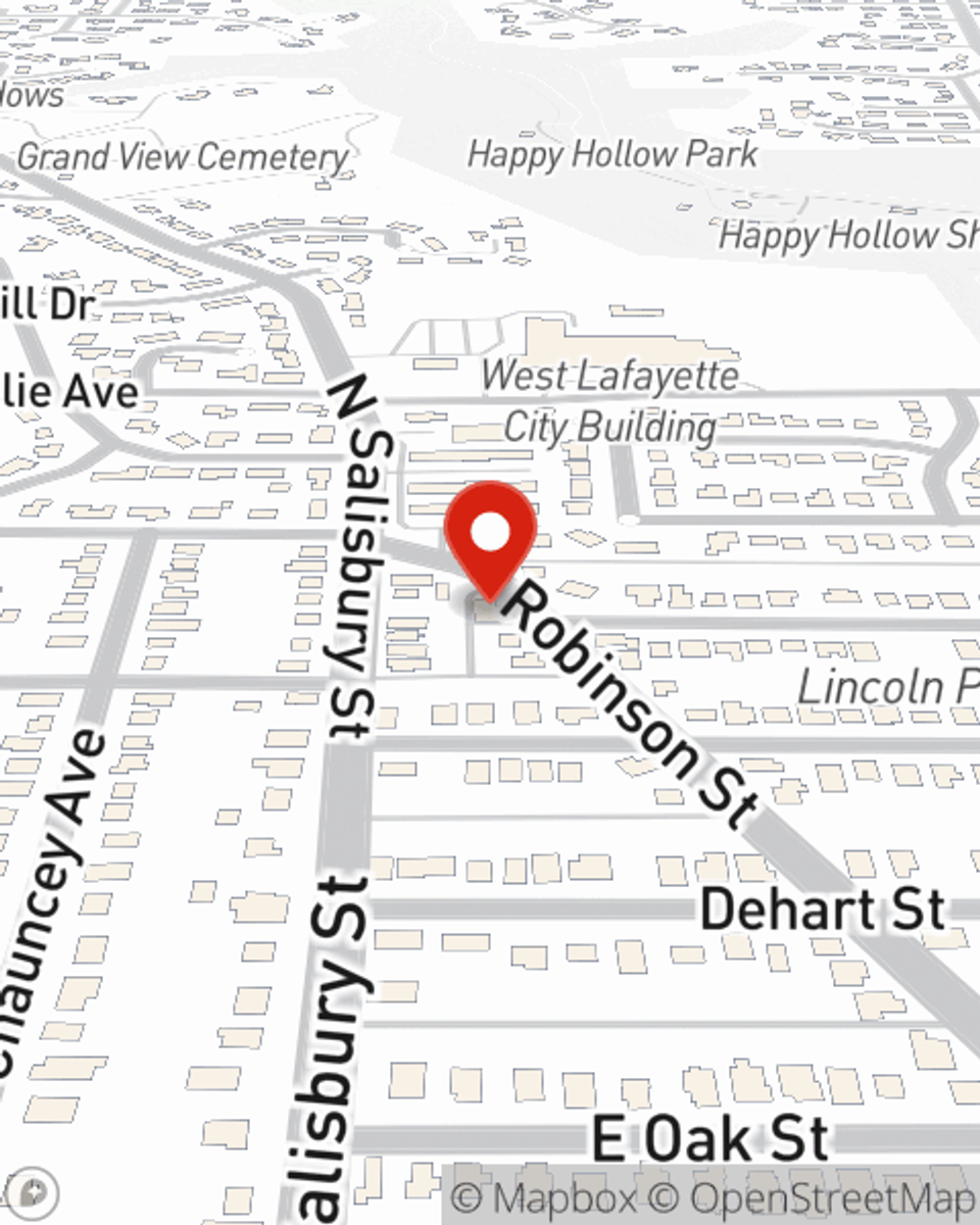

Business Insurance in and around West Lafayette

Searching for coverage for your business? Search no further than State Farm agent Neil Klemme!

Helping insure small businesses since 1935

Help Prepare Your Business For The Unexpected.

Preparation is key for when a catastrophe happens on your business's property like an employee getting injured.

Searching for coverage for your business? Search no further than State Farm agent Neil Klemme!

Helping insure small businesses since 1935

Get Down To Business With State Farm

Protecting your business from these possible accidents is as easy as choosing State Farm. With this small business insurance, agent Neil Klemme can not only help you personalize a policy that will fit your needs, but can also help you submit a claim should a mishap like this arise.

Eager to identify the specific options that may be right for you and your small business? Simply reach out to State Farm agent Neil Klemme today!

Simple Insights®

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.

Neil Klemme

State Farm® Insurance AgentSimple Insights®

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.